Overall, less total debt has been issued thus far in 2020 than in 2019. States with small populations such as Alaska and South Dakota have lower shares of GDP and lower amounts of bond debt, especially this year. Large states such as California, Texas and New York have high shares of GDP and total debt amounts. This relationship means states with higher shares of total GDP also have more copious amounts of debt in the form of municipal bonds. There is a tight relationship between the share of GDP and the amount of debt issued for 20.

In contrast, the 2020 data account for bonds already issued or planned to be issued as of June 9, 2020.Īs discussed above, states may issue more bonds than those currently in the data set by the end of the year thus, the 2020 numbers represent a lower bound of issuance for each state for this year. When looking at the differences between 20 issuances, it is essential to note that the 2019 data account for the entire universe of municipal bonds. Still, it should be noted that a portion of bonds are issued by entities within the states and not the states themselves. For simplicity, we reference just the state for which a bond was issued. In Figure 1, we grouped all bonds at the state level and plotted them against their share of gross domestic product (GDP). The picture of the municipal bond market is not complete if we do not understand the most important states in this market. NOTES: Numbers do not equal 100 due to rounding. SOURCES: Refinitiv Eikon data and authors’ calculations. Other interesting categories include public health initiatives such as water and sewer funding and pollution control infrastructure projects such as airports, mass and rapid transit, and housing and gas and other utilities.

Altogether, these five categories account for nearly 64% of amounts outstanding for 2020. When added together, the health care sector reached 11% of the amount issued in 2020. Health care has two categories-hospitals and other health care, which includes nursing homes. Education-related bonds are in the second and third categories, with primary and secondary education having almost 19% of the amount issued and higher education slightly more than 8%. The largest category is general purpose or public improvements, with more than 25% of the amount issued. The amount outstanding was replaced with zero for 2,081 bonds with missing information. The table below shows the percentages of the amounts issued or planned to be issued for 2020 by purpose. The data give the value in billions of all bonds issued in each state in 2019. We also use data on bonds issued in 2019 compiled by the Municipal Securities Rulemaking Board (MSRB).

In previous years, issuances in this market were more than twice this amount. The bonds in our data set accumulate to a total outstanding amount of slightly more than $200 billion. As a result, our information certainly does not cover all the issuances for 2020-since municipalities will still be able to issue bonds throughout the year-but it serves as a snapshot of market conditions.

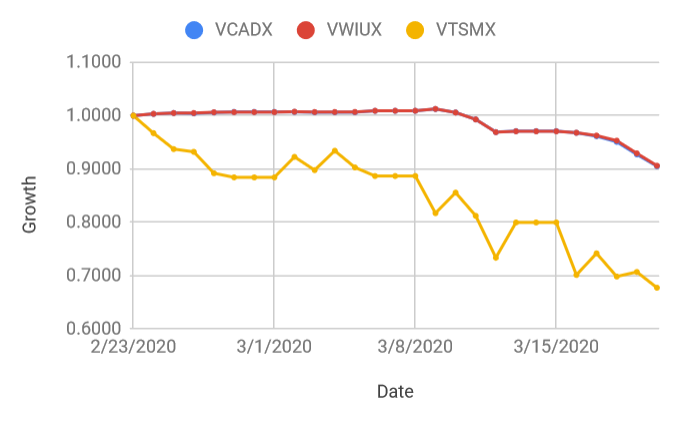

It includes all bonds already issued in 2020 or with planned issuance this year, as of the above date. A large variety of local institutions participate, including states, counties and cities, other municipalities, school districts, and many others.įor this article, we constructed a data set on June 9, 2020, using 57,401 municipal bonds from the Refinitiv Eikon database. In the U.S., different local governments issue bonds in the municipal bond market. This article revisits the main features of the market and analyzes the distress it suffered during the early months of 2020. A delayed tax-filing deadline, increased spending in response to the virus and a general lack of liquidity have all contributed to the market’s challenges. While the entire economy is suffering because of the COVID-19 pandemic, a sector hit particularly hard has been the municipal bond market.

0 kommentar(er)

0 kommentar(er)